The Buzz on Feie Calculator

Wiki Article

Not known Details About Feie Calculator

Table of ContentsThe 6-Minute Rule for Feie CalculatorThe Greatest Guide To Feie Calculator6 Easy Facts About Feie Calculator DescribedGetting My Feie Calculator To WorkNot known Factual Statements About Feie Calculator

He offered his U.S. home to establish his intent to live abroad completely and applied for a Mexican residency visa with his better half to assist meet the Bona Fide Residency Examination. Neil directs out that purchasing home abroad can be challenging without initial experiencing the area."It's something that individuals require to be really attentive concerning," he says, and advises deportees to be cautious of usual mistakes, such as overstaying in the United state

Neil is careful to mindful to Stress and anxiety tax united state that "I'm not conducting any performing in Service. The U.S. is one of the couple of nations that taxes its residents no matter of where they live, indicating that also if a deportee has no earnings from United state

tax returnTax obligation "The Foreign Tax obligation Credit scores permits people working in high-tax countries like the UK to offset their U.S. tax obligation obligation by the quantity they have actually already paid in taxes abroad," claims Lewis.

Getting My Feie Calculator To Work

Below are some of the most frequently asked questions concerning the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) allows united state taxpayers to omit up to $130,000 of foreign-earned revenue from government revenue tax obligation, lowering their U.S. tax obligation. To get approved for FEIE, you must fulfill either the Physical why not look here Visibility Test (330 days abroad) or the Authentic Residence Examination (confirm your key residence in a foreign nation for a whole tax obligation year).

The Physical Presence Test likewise needs U.S (Form 2555). taxpayers to have both a foreign revenue and an international tax obligation home.

Some Known Factual Statements About Feie Calculator

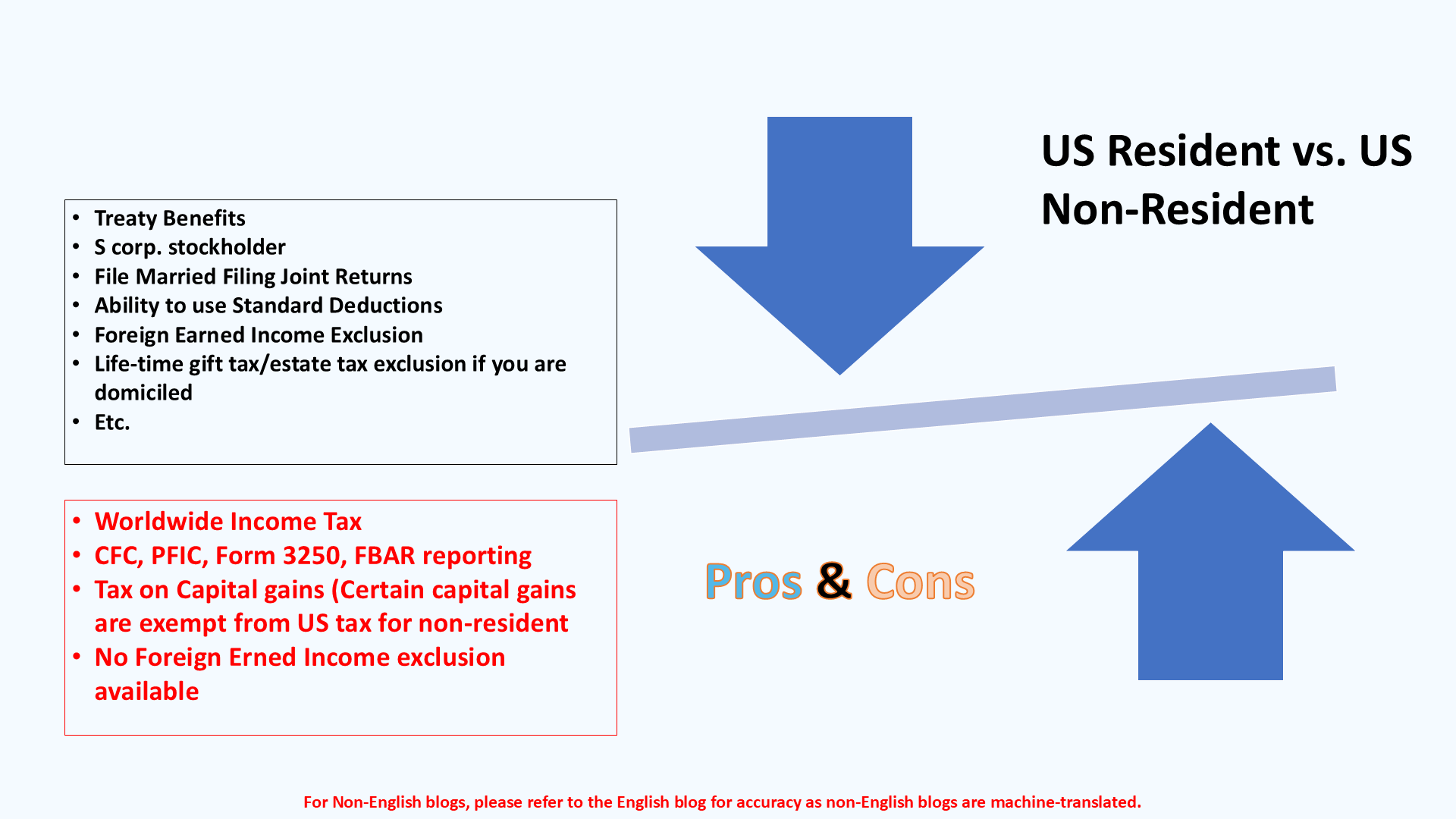

An income tax treaty between the U.S. and one more country can help protect against dual tax. While the Foreign Earned Income Exemption decreases gross income, a treaty may provide additional benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a required declare united state people with over $10,000 in international monetary accounts.Qualification for FEIE depends on meeting specific residency or physical existence examinations. He has over thirty years of experience and currently specializes in CFO solutions, equity compensation, copyright taxation, marijuana tax and divorce relevant tax/financial planning issues. He is a deportee based in Mexico.

The foreign earned revenue exemptions, often described as the Sec. 911 exclusions, exclude tax obligation on incomes made from functioning abroad. The exclusions consist of 2 parts - an income exemption and a housing exemption. The following Frequently asked questions talk about the advantage of the exemptions including when both partners are deportees in a general manner.

The Best Strategy To Use For Feie Calculator

The tax benefit omits the revenue from tax obligation at bottom tax obligation rates. Formerly, the exclusions "came off the top" minimizing earnings topic to tax at the leading tax rates.These exemptions do not exempt the salaries from US taxation yet merely provide a tax reduction. Keep in mind that a solitary person working abroad for all of 2025 who gained concerning $145,000 without any other earnings will have gross income minimized to no - efficiently the exact same solution as being "tax obligation cost-free." The exemptions are calculated each day.

Report this wiki page